The Affordable Care Act requires certain companies to provide eligible employees with an appropriate health care plan.

There are several different penalties that are enacted by the IRS if a company fails to comply with ACA regulations. Non-compliance may put the entire business at risk, because many companies can't withstand the initial penalties.

Even when a company is able to have dedicated HR and legal departments, they still may need expert outside help in order to ensure that their policies are in compliance with the ACA.

The Advantages of Using an ACA Compliance Service

ACA compliance service automates tracking employee hours, generating required reports, and completing other administrative tasks. This saves companies' HR teams significant time and effort compared to manual tracking and reporting. Using a service also ensures accuracy by correctly calculating key metrics like full-time equivalent employees. A compliance service keeps companies updated on changes to ACA rules and deadlines. Staying current amidst evolving regulations is difficult, but the service handles this.

A company whose purpose is to ensure compliance will be able to provide much more reliable assistance than an HR team that is not as familiar with the details of the ACA.

There are several reasons that an ACA compliance service provider may be the right choice for your business:

The ACA is highly complex

The text of the ACA itself adds up to about 20,000 pages. It can be difficult to figure out exactly which sections are applicable for your company. An outside expert will have in-depth experience with the ACA and can determine which sections of the complex law are relevant for your organization.

Data gathering from all sources necessary is difficult

In order to report compliance, you'll need to gather data from a variety of sources, and the systems that provide this data may not all easily integrate with your HR software. It can be tricky to determine exactly what you need to send to the IRS. Affordable Care Act experts know exactly what information you need, and how to gather it, so that you'll be able to prove that you're in compliance with the ACA.

Be prepared for reporting and audits

Some ACA compliance service vendors can handle all aspects of bringing your company into compliance and reporting the necessary data to the IRS. Some software even can help you keep year over year records. This is great insurance in the case of an IRS audit. Without a vendor to maintain this system, you may find yourself having to deal with a network of accountants, legal firms and healthcare consultants when you need to report your ACA compliance.

Experts offer you a comprehensive solution that is customized for you. With their expertise, you'll rest assured that your company won't face IRS penalties, and of course that you're offering an appropriate level of healthcare coverage to your employees.

If you need help with the ACA, contact us. We offer full-service ACA Compliance and Reporting, and we specialize in complex large businesses. Learn more about our ACA Solution here.

Our ACA Glossary

Affordable coverage: ACA provisions state that your employer health plan must be affordable. This is defined as no employee paying more than 9.5% of their family income on health insurance premiums.

Administrative period: The administrative period a certain period of time in which the employer calculates employees' average hours worked, in order to determine their eligibility for benefits. This period can be up to 90 days, and most companies align this period with their open enrollment. Keep in mind that many well-integrated HR systems with an ACA module can do this calculation in a matter of minutes.

Applicable Large Employer (ALE): An Applicable Large Employer is one who has 50 or more full-time or full-time equivalent employees or full-time equivalent employees on average for the previous year. This status us updated each calendar year. ALEs are subject to the Employer Shared Responsibility and Reporting provisions of the ACA.

Consolidated Omnibus Budget Reconciliation Act (COBRA): Certain qualifying events allow a person to elect COBRA coverage. The main situation in which COBRA coverage is used is when employment ends, and they can choose to maintain their coverage for a certain amount of time. Another situation is when a person ceases to be a dependent of an employee and thus would lose coverage. In order to receive this coverage, a person will pay 100% of the premium, including the share that the employer previously covered, along with an administrative fee.

Employer health plan: This is the coverage offered to an employee by their employer. It's also called a job-based health plan.

Employer shared responsibility and reporting: These are the provisions in the ACA that require ALEs to offer affordable coverage plans to all eligible employees and their dependents. ALEs are required to report these offers of coverage to the IRS, as well as provide their employees with statements reporting this information. People also refer to these provisions as the “employer mandate” or the “pay or play provisions,” the latter of which refers to the fines employers will face if they do not provide the required coverage.

Essential Health Benefits: There are ten categories of essential health benefits that an employer's plan must cover in order to be in compliance with the ACA:

- Ambulatory (outpatient) patient services

- Emergency services

- Hospitalization (such as surgery and overnight stays)

- Pregnancy, maternity, and newborn care

- Mental health and substance use disorder services, including behavioral health treatment like counseling and psychotherapy

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care (adult dental and vision coverage are optional health benefits not required in health plans)

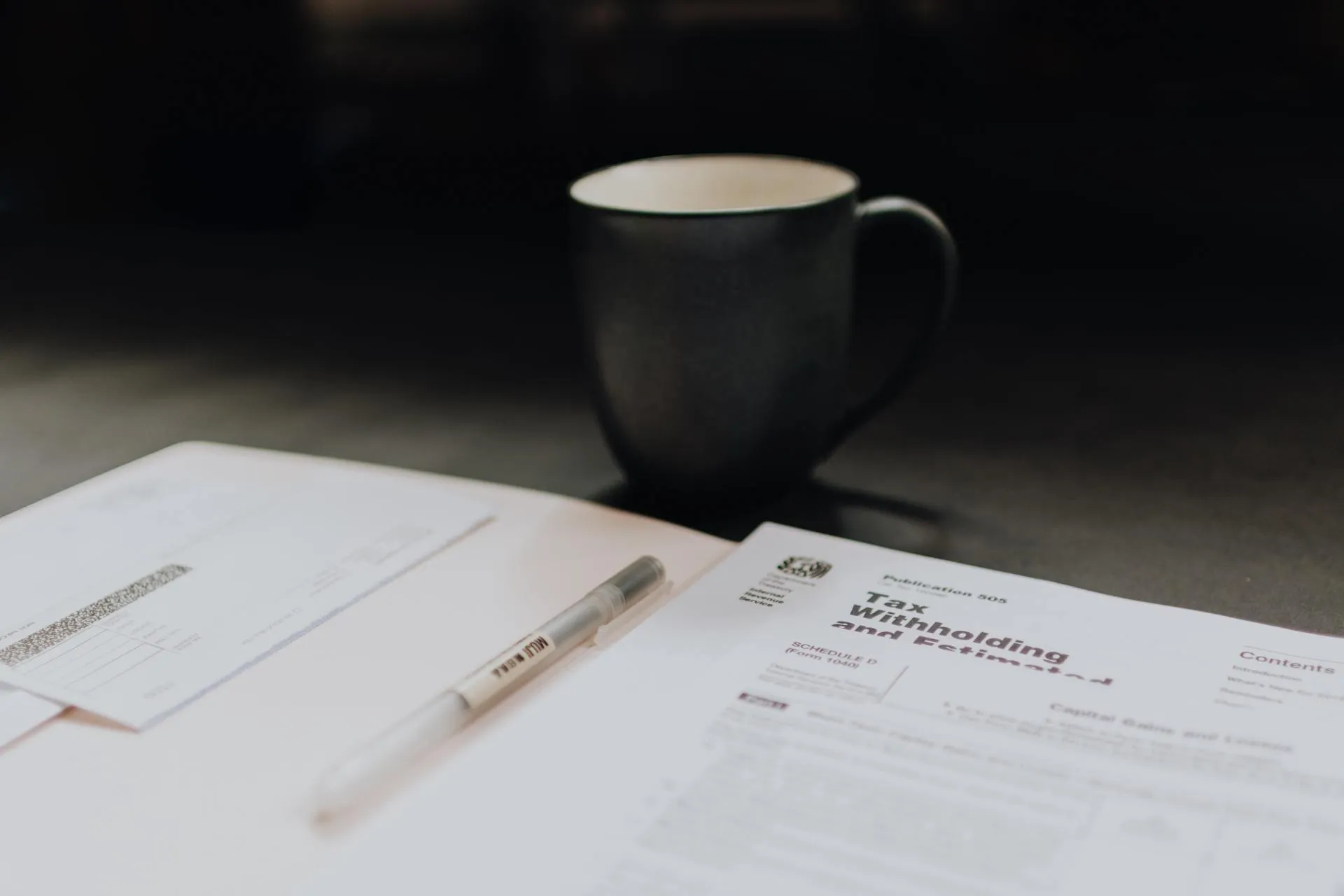

Form 1094-C: ALEs are required to use Form 1094-C to report whether they offered affordable minimum essential health coverage (MEC) and enrollment in MEC for all eligible employees.

Form 1095-C: ALEs must prepare Form 1095-C for every employee who worked 130 or more hours in a month, whether or not they were enrolled in an employer health plan, as well as for any part-time employee that was enrolled in an employer health plan. This form provides employees with important information that they'll need in order to complete their individual tax returns, because Line 61 of those returns requires that employees show whether they or their family members had minimum essential coverage.

Forms 1094-C and 1095-C are used by the IRS to determine whether an employer has properly complied with the ACA. If they are not compliant, they will be penalized and will owe payment under the Employer Shared Responsibility provisions, section 4980H. These forms are also used to determine employees’ eligibility for the premium tax credit.

Need ACA compliance help?

ACA Reporter has successfully been helping our clients achieve compliance. We understand the risk of ACA penalties, and we provide expedited IRS penalty response for our clients. Learn more about our ACA Compliance & Reporting solution or Contact Us with any questions you may have.