State Level ACA Reporting

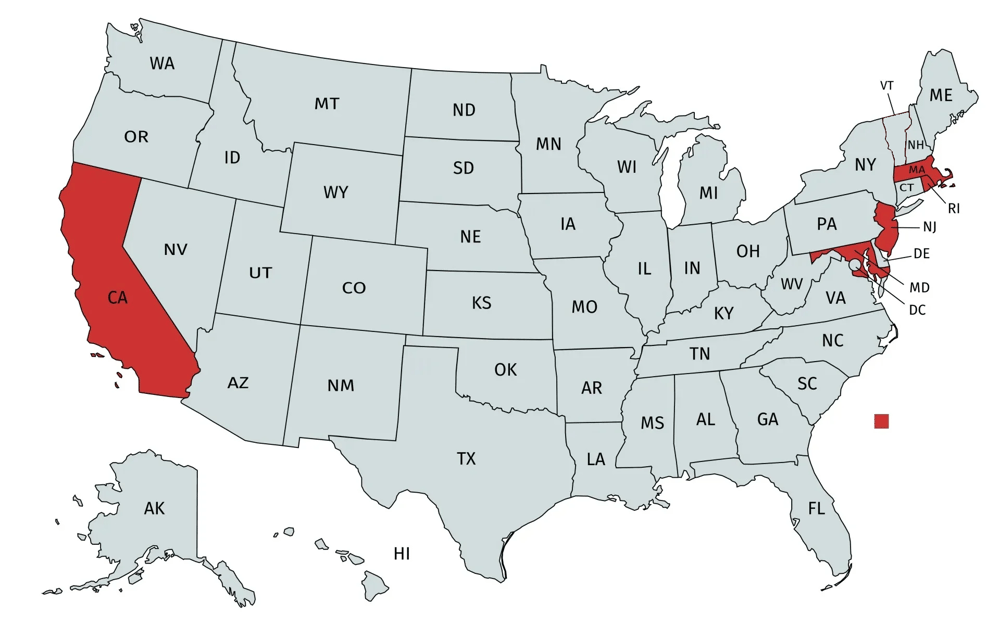

The following states have passed individual state mandates requiring ACA Reporting:

- California

- Massachusetts

- New Jersey

- Rhode Island

- Washington D.C.

If your business has as little as one employee filing taxes in these states, your business must comply with that state's individual reporting requirements. All companies will have to be ACA compliant at the federal level while also being compliant at the individual state levels. This will make it difficult for businesses and companies to continue staying on top of the different regulations and ACA Reporting requirements. If your company needs assistance with either, please reach out to us directly here.

California

The state of California requires all Applicable Large Employers (ALEs) to send their ACA reporting information to the California Federated Tax Board. This information should be sent every year.

California has a January 31st deadline for distributing your 1095 forms to your employees.

Massachusetts

In the state of Massachusetts, companys who provide a fully insured plan can fulfill their requirement by filing 1094-C and 1095-C forms with the IRS. Companies that offer self-insured healthcare plans have to send their 1099-HC forms directly to the state of Massachusetts.

New Jersey

New Jersey, similar to California, requires Applicable Large Employers (ALEs) to file all of their ACA compliance information with the state as well as with the IRS.

Companys must provide forms 1094-C and 1095-C to the state, and also meet all of the federal filing and 1095-C distribution requirements.

For New Jersey, the filing deadline is March 31st.

Rhode Island

Employers working in Rhode Island must provide the complete 1095-Cs to their employees. Companys must file the returns with the state's Division of Taxation (DOT).

Rhode Island ACA reports have to be uploaded to the state's website and must be filed by March 31st.

Washington D.C.

In Washington D.C., Applicable Large Employers (ALEs) must provide coverage and compliance information to the Office of Tax and Revenue (OTR). These companies must submit a statement about the coverage type as well.

The rules for Washington D.C. are quite similar to the filing requirements under normal ACA law, however there are a couple of key differences. The Office of Tax and Revenue requires information returns to be electronically filed through the MyTaxDC system, and they do not at all allow paper filing.

For Washington D.C., you must submit your annual reports by April 30th.