For the 2017 tax year, the IRS is issuing Letter 5005-A, Information Return Penalty Notice Forms 1094-C or 1095-C, demonstrating its efficiency in identifying non-compliance with ACA's employer mandate and increasing enforcement efforts.

What Is Letter 5005-A?

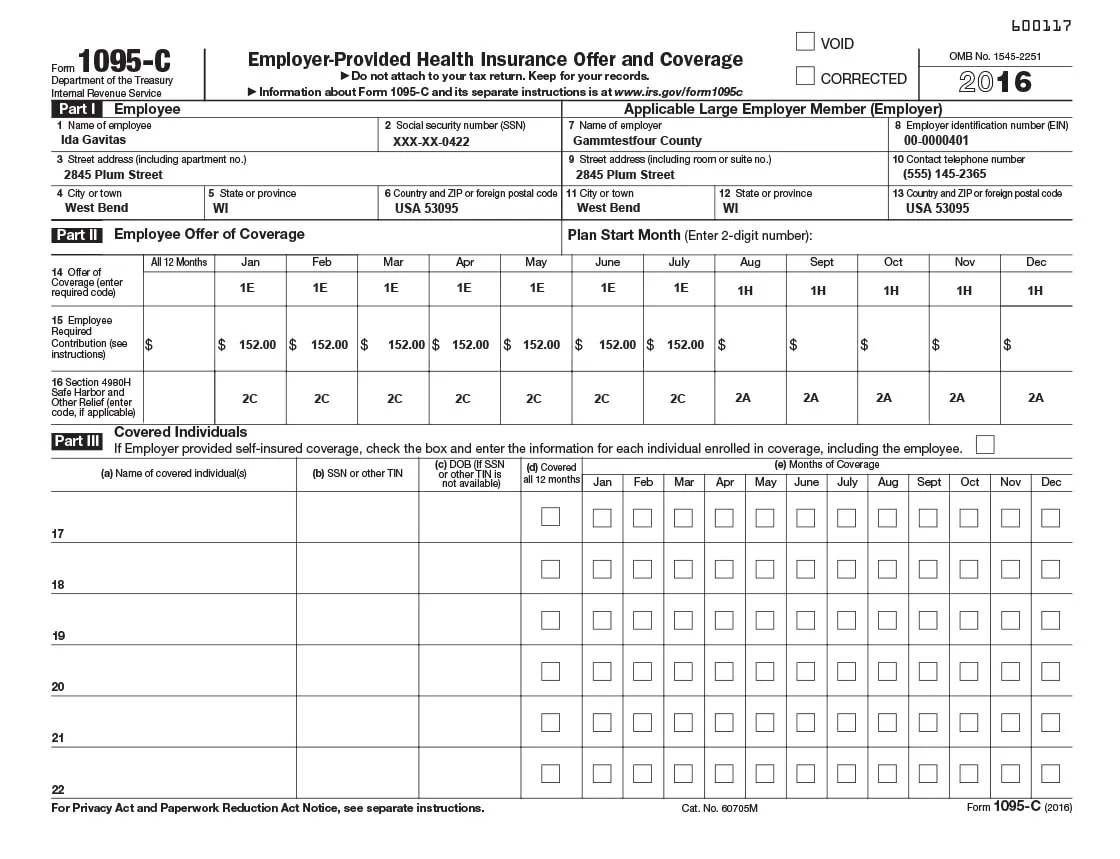

Letter 5005-A is the penalty notice that follows the IRS' Letter 5699, issued to Applicable Large Employers (ALEs) for failing to file or furnish the ACA Forms 1094-C and 1095-C as required under 6721/6722 IRC Sections.

Why Is Letter 5005-A Issued to Applicable Large Employers?

Letter 5005-A is issued to Applicable Large Employers (ALEs) for the 2017 tax year who failed to:

- File forms 1094-C and 1095-C to the IRS

- Furnish forms 1095-C to employees under IRC 6721/6722

These penalty notices focus on the failure of ALEs to file 1094-C and 1095-C forms to the federal tax agency and furnish 1095-C forms to employees by required deadlines. For the IRS to determine the penalty assessment for an employer who failed to file or furnish the applicable ACA information, the agency cross-references the number of W-2's filed by a specific employer that year. Letter 5699 is issued to employers to determine if they have failed to file or furnish their ACA information results as required. The IRS asks employers to:

- Provide the date the filing was made

- Confirm the name they used to file ACA information returns

- Give the Employer Identification Number (EIN) that is submitted

How To Avoid Letter 5005-A After Receiving Letter 5699?

Employers should be aware that if they receive Letter 5699, it is still not too late to avoid the next Letter 5005-A. The two best ways to avoid Letter 5005-A are:

- Letter 5699 gives ALEs a chance to provide their forms 1094-C and 1095-C in their response to the IRS if they do not need to file electronically. At present, employers who are required to file at least 250 Forms 1095-C must file electronically.

- The IRS also gives a chance to employers to explain why they should not be considered ALEs for the reporting year in question or to provide further explanation as to why they did not file.

What Is ACA's Employer Mandate & Its Penalties for Non-Compliance?

Under ACA's Employer Mandate, Applicable Large Employers' organizations with 50 or more full-time employees and full-time equivalent employees are required to offer Minimum Essential Coverage (MEC) to at least 95% of their full-time employees and their family members or be subject to Internal Revenue Code (IRC) Section 4980H penalties. Whereby such coverage (MEC) meets Minimum Value (MV) and is affordable for the employees.

For the 2018 Tax Year, employers should note that the IRS is also issuing Letter 226J to employers who failed to comply with the ACA's Employer Mandate. These notices are separate from Letter 5005-A and issued to employers who do not offer adequate and affordable health coverage to their full-time employees.

Takeaway

Undertaking an ACA Penalty Risk Assessment can help you determine if your organization is at the risk of receiving ACA penalties from the IRS. This assessment can also determine if the employers are considered Applicable Large Employers (ALEs) by the IRS and if they are at the risk of receiving IRS penalties.

Build and manage a better workforce with integrated HR solutions from ADP Marketplace partners like Points North.