The Affordable Care Act (ACA) has brought significant changes to the healthcare landscape in the United States, including the requirement for employers to file Forms 1095-C and 1094-C.

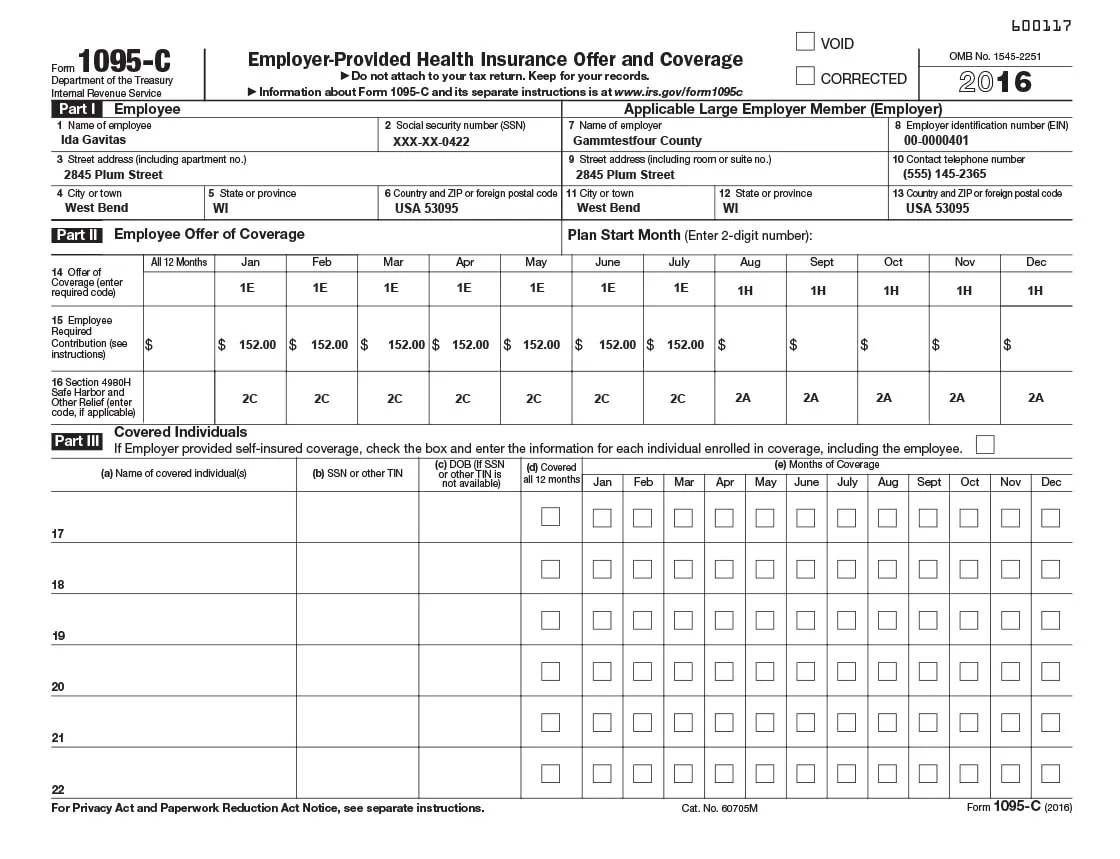

These forms provide crucial information about employer-provided health coverage and are essential for ACA compliance.

Failing to file these forms on time can lead to severe penalties and complications for companies. In this article, we will delve into the risks of not filing and provide a step-by-step guide on what to do if your company still needs to meet its filing obligations.

Penalties for Not Filing Forms 1095-C and 1094-C

The penalties for failing to file the required ACA forms can be substantial. The Internal Revenue Service (IRS) imposes several types of penalties: those related to failing to file correct information returns and those pertaining to failing to furnish correct payment statements. Both penalties can apply if forms are not filed, contain incorrect or incomplete information, or are filed late. These penalties can have a significant financial impact on business, especially for larger organizations. Some of the IRS' penalties, such as the late fee, can increase over time.

What To Do If You Didn't File Forms 1095-C and 1094-C

If your company has identified that it has not filed the required Forms 1095-C and 1094-C, it is crucial to take immediate action to rectify the situation. Here are the recommended steps to follow:

- Consult a tax professional: Seek guidance from a tax professional specializing in ACA compliance. They can provide expert advice tailored to your situation and help you navigate the necessary steps for filing the missing forms.

- Reach out to an ACA compliance software company: Engage the services of an ACA compliance software company, such as Points North, that specializes in generating your required ACA forms and can handle historical filing. These companies offer robust software solutions that can streamline the process and ensure accurate and timely filing for the future. They can assist you in generating the historical 1095-C and 1094-C forms based on your company's data.

- Gather historical payroll data: Collect the necessary historical payroll data required to complete Forms 1095-C and 1094-C accurately. This information includes employee details and relevant payroll data for each calendar year for which the forms were not filed. You may also need hours for previous years if you are using the look-back measurement method. Collaborate with your HR and payroll departments to ensure the accuracy and completeness of the data.

- Compile enrollment and waiver data: Gather the enrollment and waiver data for each applicable calendar year. This information is vital for accurately reporting employee participation or their waiver of employer-provided health coverage. Collaboration with your benefits administration team or insurance providers will help ensure the completeness and accuracy of this data.

- Review and verify data: Thoroughly review and verify all collected data before generating the past due forms. Accuracy is crucial to fulfill your ACA compliance obligations.

- File the historical Forms 1095-C and 1094-C: Once all the necessary data has been compiled and verified, use the services of the ACA compliance software company to generate the historical Forms 1095-C and 1094-C. File these forms with the IRS and provide the required copies to employees within the specified deadlines. If using a program like ACA Reporter, it can help you file these forms.

ACA compliance is essential for companies to avoid penalties and ensure adherence to healthcare regulations. Failing to file Forms 1095-C and 1094-C can have severe consequences. However, companies can rectify the situation with the right approach and assistance from tax professionals and ACA compliance software companies like Points North.

Click here to learn more about how we can help you with your backfiling needs.

.png)