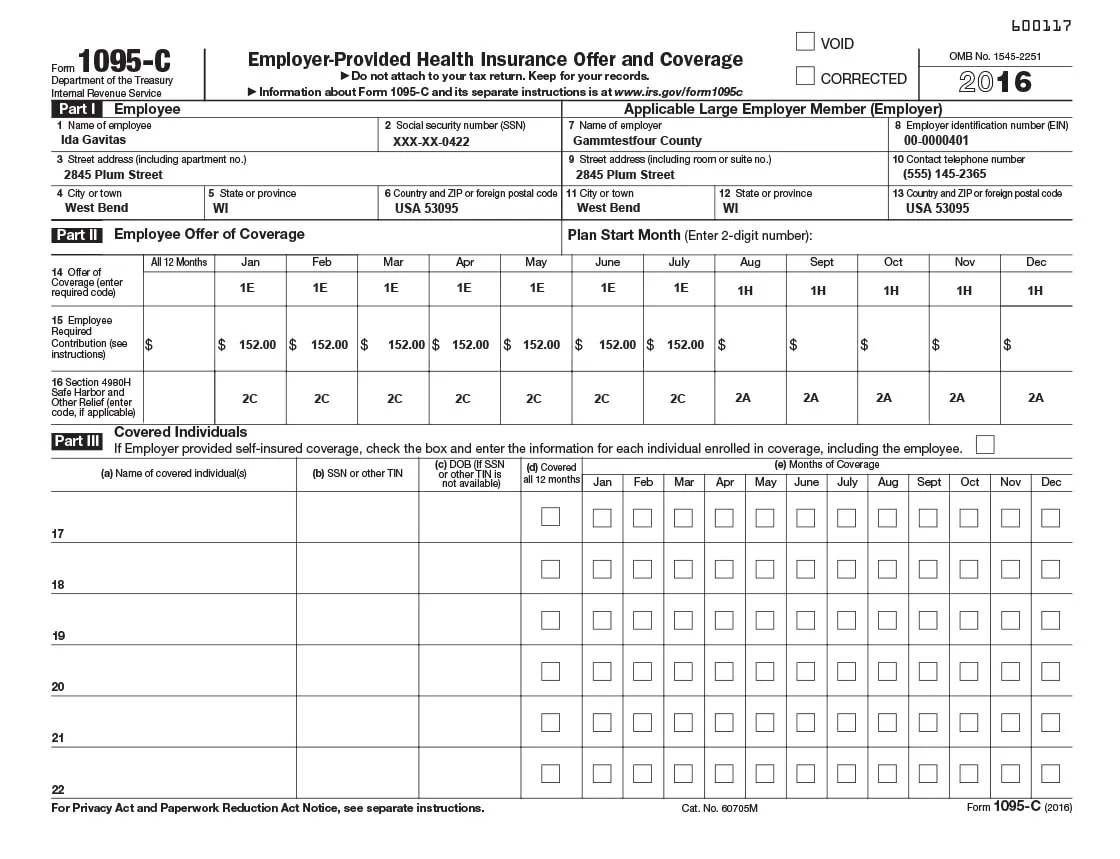

The information required to complete 1095-C, 1095-B and the 1094-C forms typically comes from a number of systems and sources. When e-filing ACA forms, you can input that data as it is completed and submit the forms, mail and e-file when you are ready.

- No need to install another software program on your computer or network. Accessing your forms, filing data and following your progress are all possible from anywhere.

- Rely on timely updates and information all year long. We closely follow developments and new guidelines issued by the IRS to ensure our software is always up to date and you have the information you need to keep pace with changes.

- Secure access to your filed forms and records after you file. Enjoy secure online access to completed forms for at least four years. And if you choose, you can print copies for off-line storage.

Once I file my 1095-B or 1095-C forms, do I need to file Form 1094-B or 1094-C?

For self-insured employers completing 1095-B forms, we will automatically include the 1094-B transmittal form with your submission at no additional cost. When filing 1095-C forms, you must also file a separate 1094-C form available through the site that requires additional information from employers regarding:

- Whether the organization offered coverage to at least 95% of its full-time employees and their dependents.

- The total number of 1095-C forms issued to employees.

- Information about members of the aggregated applicable large employer group, if any.

- Counts of full-time employees on and total employee counts by month.

- Whether the company is eligible for certain transition relief, including certification.

When will my employees receive their forms?

If you choose our e-delivery option, your employees will receive an email with a link to their forms within 24 hours of your order submission. Employee copies that are mailed will be processed within 2 to 3 business days of your order and delivered to the post office for first-class mail delivery.

The U.S. Postal Service typically delivers first-class mail within 5-7 days, although we cannot guarantee postal delivery times. You will be notified on the date that your forms are delivered to the post office. Note: recipients will not receive forms if you select the E-File Only service option.

Can I file for more than one company using a single account?

Yes. You can add an unlimited number of employers and employees under a single account if you choose. When creating the form, simply select the correct company and employee from the drop-down boxes on the form. All related data will then be filled in automatically.

What if I want copies of my forms?

After you submit your forms and payment, you can log into your account and will have access to copies of your forms in PDF format. You’ll find your forms in the "Filing Center" tab located at the top of the homepage. Click on the tab and select "Filed Forms." Use the filters to find the forms you want and then click "Apply." Once your employee information appears on screen, select the employee records and click the "Copy" button for any forms you want to print.

What are the penalties if I don't file?

Employers can pay a high price for failing to comply with ACA reporting requirements. In addition to the IRS ramping up penalty amounts, the punitive nature of penalties means the combined cost can add up quickly.

The amount of the penalty is based on when you file the correct information return or finish the correct payee statement. Also, the penalty for failure to file a correct information return is separate from the penalty for failure to furnish the correct payee statement. For example, if you fail to file a correct 1095-C with the IRS and don’t provide a correct statement to the payee, you may be subject to two separate penalties. And depending on the oversight, the maximum amount you can incur in the calendar year can reach into the thousands.

How safe is the data I enter on your website?

All company and employee data is encrypted using the highest level encryption program available, recommended by the federal government. Any information you provide is used only for the purpose of processing your forms. We will never share your information or sell it even if you no longer use our service. Please refer to our Privacy Policy for complete details.

Time to Take Action

The Affordable Care Act has been one of the most-talked-about HR and healthcare topics for several years running. The Employer Shared Responsibility rule requires employers to file annual information returns with the IRS and send summary statements to employees to verify that the “minimum essential coverage” is being met. We’ve developed efileACAforms.com to help you meet these requirements, confidently and quickly.

- Easily meet the new IRS deadlines: mailed recipient copies are due

- Complete and accurate forms creation and e-filing is easier than you may think. Our service guides you step by step through the process.

- Turnkey service, from data input through mailing to employees and e-filing with the IRS, enables you and your team to get more done in less time.

- Protecting your employees' personal information and privacy is guaranteed with our SOC2-certified and HIPAA –compliant software and print and mail facility.

Contact us to learn more about how we can help make ACA reporting easy.