The home healthcare industry has several unique challenges for Affordable Care Act (ACA) compliance. With a high number of hourly employees working unpredictable schedules across multiple sites, meeting reporting requirements can be overwhelmingly difficult. Given the complexity of ACA regulations for home healthcare providers, having rigorous systems and software in place is critical to avoid noncompliance and penalties.

Unique Challenges Presented by Home Healthcare

Home healthcare organizations face unique complications in complying with ACA's employer reporting rules. Many staff members work on an hourly or per-visit basis, often with wildly fluctuating schedules from week to week. Employees may juggle various roles across multiple sites as needed. With such variability, capturing precise ACA data can be a huge task with all these complicating factors:

- Hourly Home Health Aides - These frontline workers, who provide elderly and disabled clients with daily assistance, are almost always classified as variable- hour employees under the ACA. With schedules changing continuously, tracking hours to assess ACA full-time status is challenging.

- Nurses and Therapists - These employees often split their time between serving multiple clients at different locations on an hourly or per-visit basis. Their unpredictable schedules make accumulating data for ACA reporting difficult.

- Field Staff and PRN Workers - Employees who work on an as-needed basis across different sites further complicate ACA compliance. Tracking their varied hours and offers of coverage adds complexity.

- Potentially High Job Turnover - High turnover means employee data is always fluctuating. This makes keeping track of FTE counts each month for ACA compliance more difficult.

- Many Locations - Larger home health companies may serve clients across a wide geographic region, with employees working at hundreds of sites. Gathering data is harder with so many moving parts.

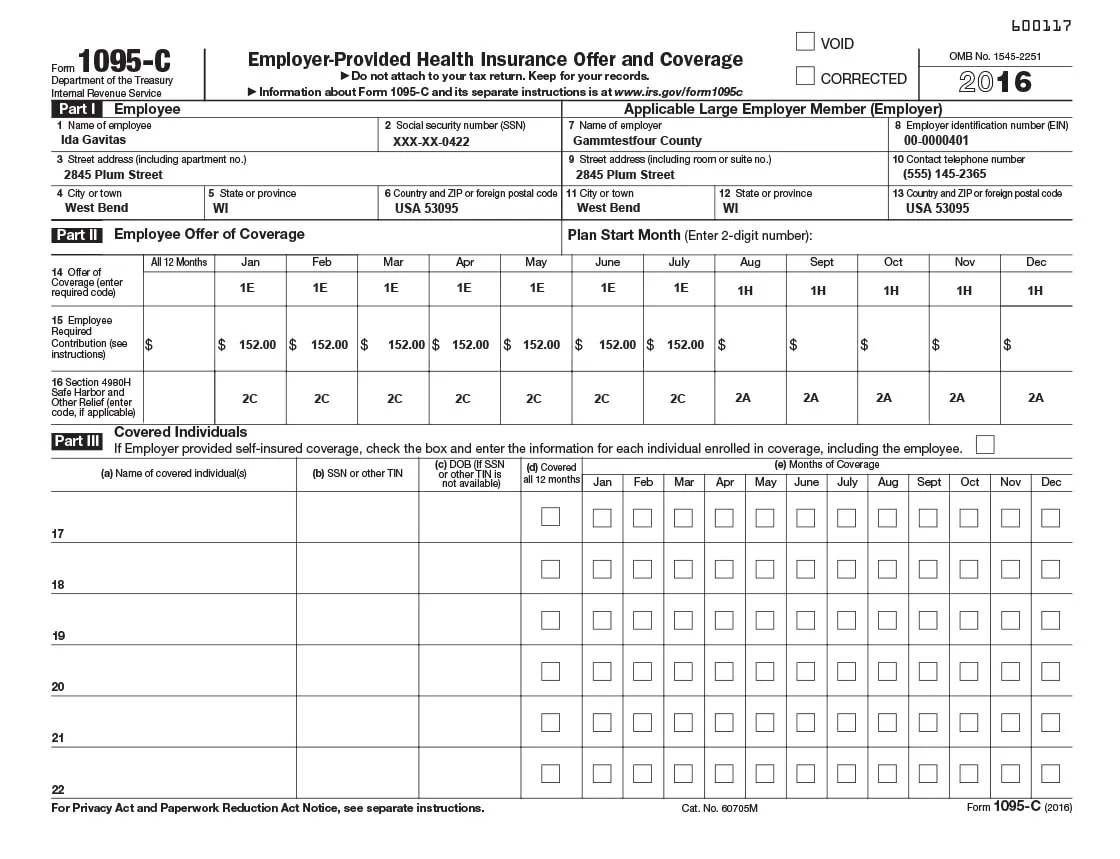

This high variability among the home healthcare workforce creates serious challenges for ACA compliance. Capturing accurate and complete data, performing intricate calculations, and generating error-free 1094/1095 forms is hugely difficult for home healthcare employers. Staying on top of ACA reporting requirements demands tighter control and oversight.

Harsh Penalties for Non-Compliance

Given the increased difficulties surrounding ACA compliance in the home healthcare industry, attention to detail and data aggregation is critical. Failing to comply with ACA requirements exposes companies to substantial penalties.

Per the IRS, employers who do not meet ACA's employer-shared responsibility provisions face fines of hundreds per month per applicable full-time employee, which can quickly add up to hundreds of thousands for larger organizations. On top of this, errors or omissions on ACA information returns 1094-C and 1095-C can lead to additional fines of hundreds per form, up to a maximum annual penalty of over 3 million dollars.

With home healthcare companies already facing slim profit margins, these potentially massive penalties could have crippling financial effects. And beyond direct fines, noncompliant organizations also risk IRS audits, public scrutiny, and damage to their reputations and client relationships.

Understanding Your ACA Compliance Responsibilities

Because of the pressing need for air-tight ACA compliance among home healthcare companies, there are a few best practices to follow:

- Closely Monitor Hours and Schedules - Develop rigorous systems for keeping accurate tabs on hourly employees' variable schedules across all locations. This provides the essential data needed for proper ACA reporting.

- Perform Regular Status Assessments - Conduct rolling evaluations to determine if variable hour employees meet ACA’s full-time definition of 30 hours/week or 130 hours/month.

- Identify and Track Plan Offerings - Carefully record which health plans were offered to which employees, and when. Documentation is key.

- Calculate Affordability Correctly - Incorrect affordability calculations are common pitfalls. Leverage ACA’s formulas and safe harbors to avoid errors.

- Seek Expert Guidance - Given the complexities, consider consulting ACA compliance experts or advisory firms to ensure full understanding.

- Start Processes Early - Give yourself ample time to gather intricate data, compute figures, generate quality forms, and fix errors.

- Leverage ACA Software - Purpose-built ACA compliance software automates time-consuming reporting tasks and ensures accuracy.

For home healthcare companies, managing ACA compliance strictly in-house can be hard for in-house staff. Many organizations find it invaluable to partner with specialized ACA compliance software vendors. The right technology solution can entirely automate tracking, calculations, form generation, e-filing, ACA lifecycle management, and more. This lifts the substantial burden from employers' shoulders while avoiding mistakes that could prompt IRS penalties.

ACA Reporter software simplifies the process of tracking, managing, and reporting your organization's ACA compliance. Our automated toolset reduces the administrative burden of compliance and helps you avoid costly penalty fees.

Get a free demo today to see how ACA Reporter can make ACA compliance easy for your organization, regardless of the complexities of variable-hour employees and multiple locations. Focus on growing your business while we handle your reporting requirements.