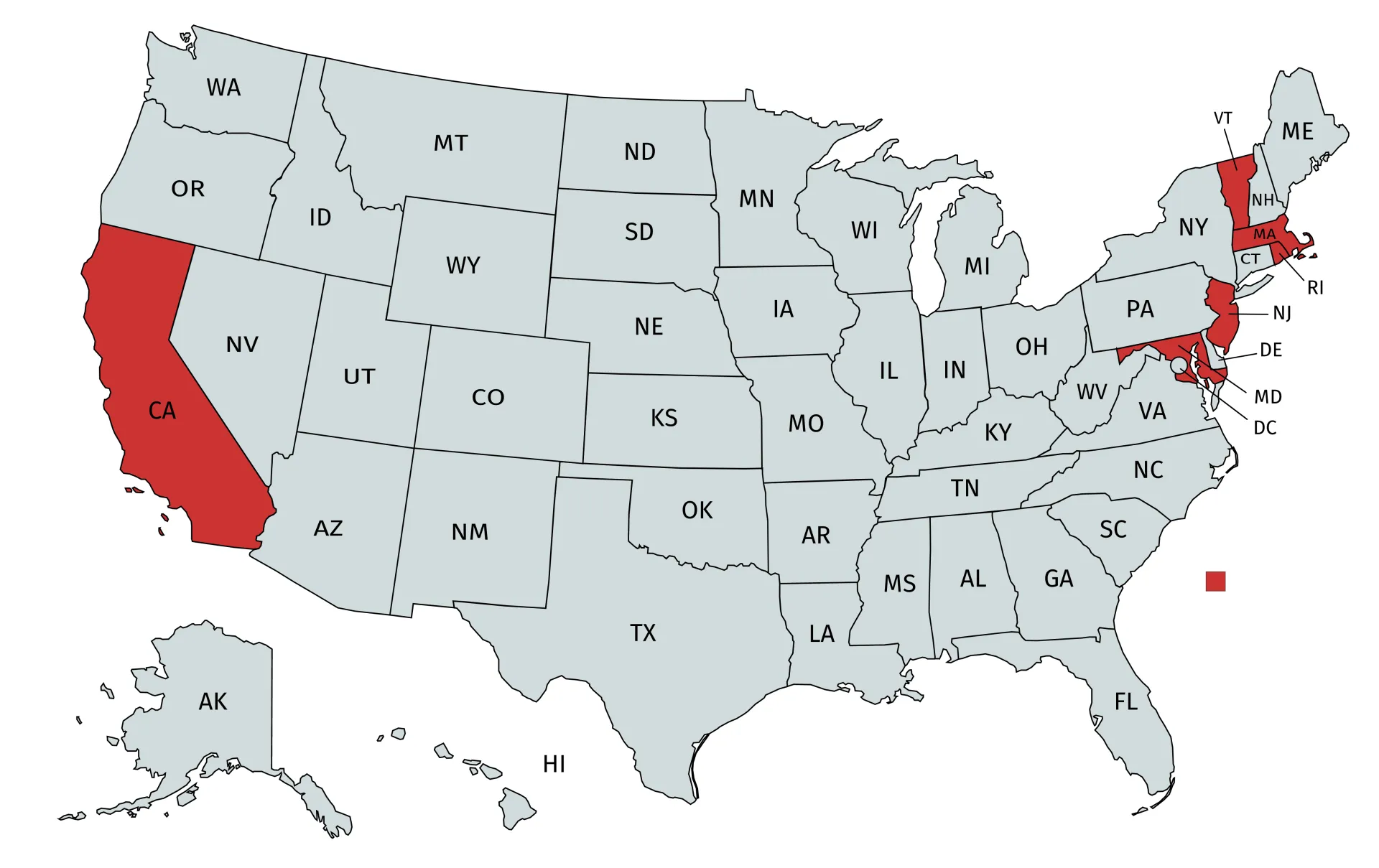

Which States Have Individual ACA Mandates?

To date, we have been reported that New Jersey, Vermont, District of Columbia, Rhode Island and Massachusetts have passed individual state mandates requiring ACA Reporting. This will make it difficult for businesses and companies to continue staying on top of the different regulations and ACA Reporting requirements.

If you have just one employee that files taxes in these states, your business must comply with your state’s individual reporting requirements. All companies will have to be ACA Compliant at the federal level while also being compliant at the individual state levels. If your company needs help with either, please reach out to us directly here.

Additionally, other states are now considering having their own state healthcare requirements. These states will include Washington, Minnesota, Hawaii, Maryland, and Connecticut.

States Requiring ACA State Level

- California

- District of Columbia

- Massachusetts

- New Jersey

- Rhode Island

- Vermont

States that are actively considering and/or pursuing a statewide individual mandate:

- Connecticut

- Hawaii

- Maryland

- Minnesota

- Washington

New Jersey Employer Information

New Jersey Issues Employer Guidance On ACA Reporting - New Jersey is one of the first to issue ACA Requirements at the state level. They have provided information for employers on third party reporting to support the state’s new requirements.

All employers that have employees in New Jersey will be required to comply with the Affordable Care Act’s Employer Mandate. using the NJ system for filing W-2 forms. The instructions have been provided here. .

Requirements for individuals

On Jan 1, 2019, Garden State residents who failed to maintain their coverage will be subject to SRP Shared Responsibility Payment on this year’s tax returns. This is due with the 2019 New Jersey income tax returns. The amount of your SRP will be based on income and your family size but will be capped out at the statewide average premium for anyone with a Bronze Health Plan.

Requirements for employers

New Jersey will use third parties to administer penalties and to verify health coverage supplied by taxpayers. The state is also looking to employers and other providers that have minimum essential coverage to New Jersey residents. They will be required to send out health care coverage returns to each state according to the 2019 tax year.

This means that in 2019, employers that have employed NJ residents will have to make a filing with each state level.

Do I Have A Reporting Requirement to New Jersey?

A common question that you may be asking is if you have to report to New Jersey, even if you don’t have a form 1094 reporting requirements that are under the ACA to the IRS. This will provide every employer sponsoring any employment health plan that has minimum coverage to any New Jersey residents will have to file a return with the state regarding the coverage.

In the absence of additional guidance from the state, employers with New Jersey residents should seek appropriate counsel concerning their reporting obligations.

If reporting is required, the state will permit employers to send the same Forms 1094/1095 that they transmit to the IRS to satisfy the Act’s requirements. However, the state encourages companies to send data pertaining only to New Jersey full-year and part-year residents as providing information on non-residents of New Jersey may raise privacy and other issues.

Employers with New Jersey employees also may want to encourage their employees who receive Form 1094/1095 from them to provide those forms to the employees’ dependents for completion of their own NJ state tax returns, if applicable.

Will the state level provide feedback similar to the IRS to let us know if it’s accepted or rejected?

Yes, states like NJ will email notifications that confirm if it’s successful with acknowledgment. The state will notify the vendor or employer if there are any issues during the process. If you’d like someone to take care of this for you, be sure to reach out to us so our team can help.

Do files that are replaced or corrected need to be shared with the IRS and with the state level?

You must provide correction files to both the IRS and state levels, while replacement files are accepted, the only way the employer can track it is if the file name is used in the transmission.

ACA Requirements Changes

States like California, Vermont and Rhode Island have already passed individual requirements. There are other states that will be considering a mandate similar to New Jerseys state-level reporting.

Employers will need a way to validate their employees coverage, and it is expected that the states that are adopting this mandate will require individuals to carry coverage on the exchange or through their employer. This will most likely be filed through a state tax form.

Expect to have forms and penalties similar to the federal ACA Reporting. If you need help with your federal or state-level ACA Reporting or just want to stay up to date with the latest news please click here to receive more information.